AKR Corporindo Net Profit FY 2022 Rp 2,403 billion – Up 116% YOY Strong growth in all business segments with Solid financials

March 22, 2023

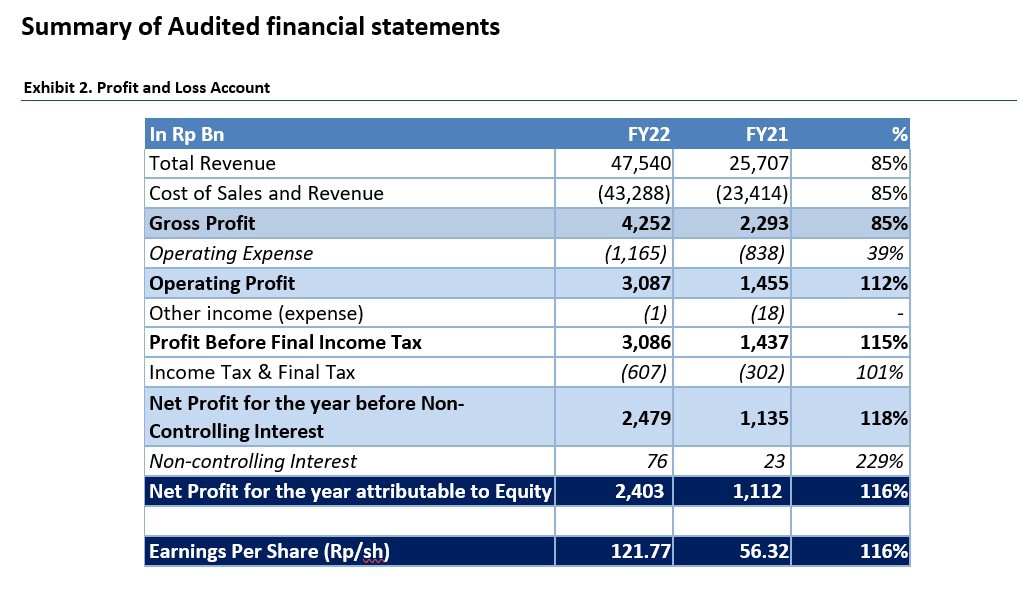

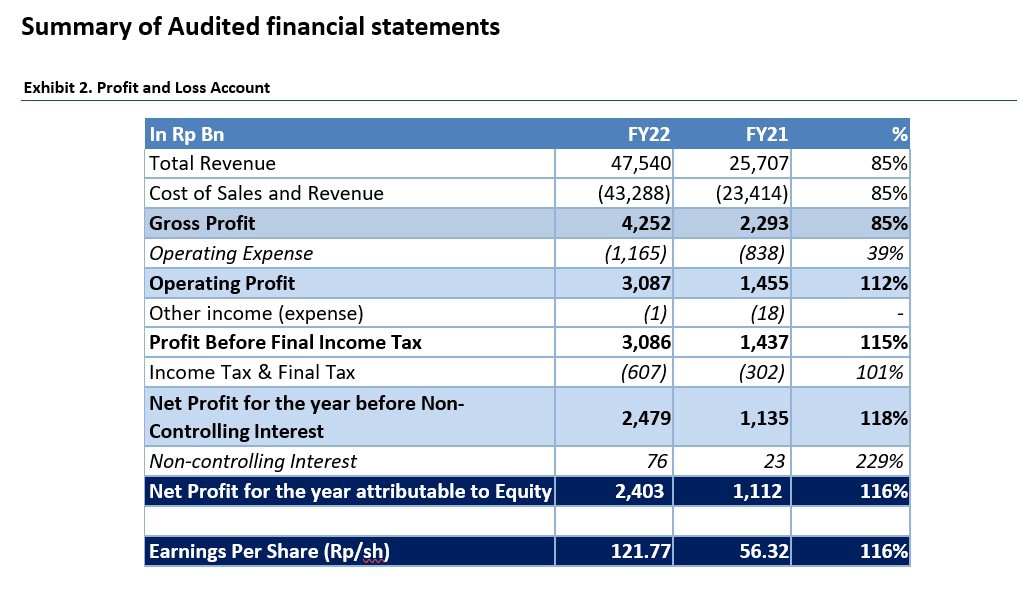

JAKARTA, 22 March 2023- PT AKR Corporindo Tbk., (AKRA:IJ) leading distributor of Petroleum and basic chemicals and developer of one of Indonesia’s largest integrated Special Economic Zone JIIPE reported that Net Profit attributable to Equity holders of parent entity rose 116% to Rp 2,403 billion during the year ended 31st December 2022 compared to Rp 1,112 billion during the year ended 31st December 2021; AKRA reported its audited financial results audited by Purwantoro, Sungkoro & Surja, member of Ernst & Young to the Indonesian Stock Exhange today; This strong performance during the year 2022 is supported by all the business segments; Consolidated Revenue during the FY 2022 is Rp Rp 47,540 billion, 85% higher than Rp 25,707 billion in the previous financial year.

Key Highlights:

- Net profit for FY 2022: Rp 2,403 billion 116%yoy growth

- EBITDA for FY 2022: Rp 3,539 Billion 89%yoy growth

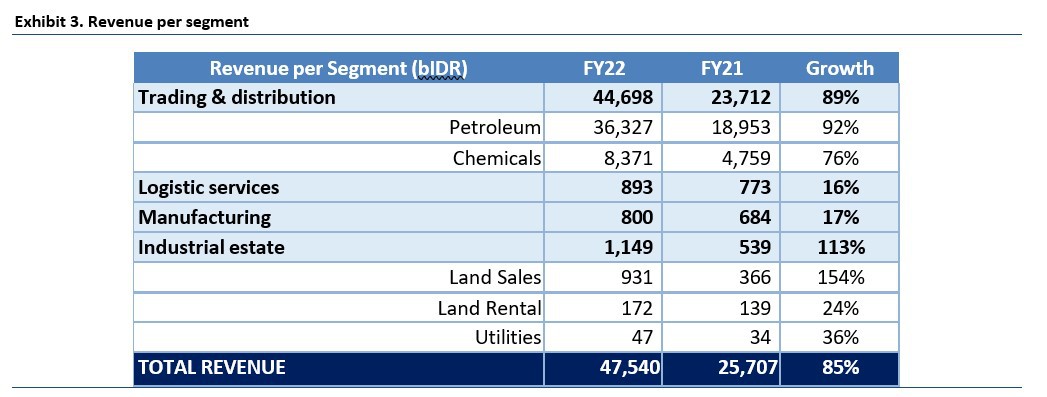

- Segment wise Sales Revenue Growth of FY 2022:

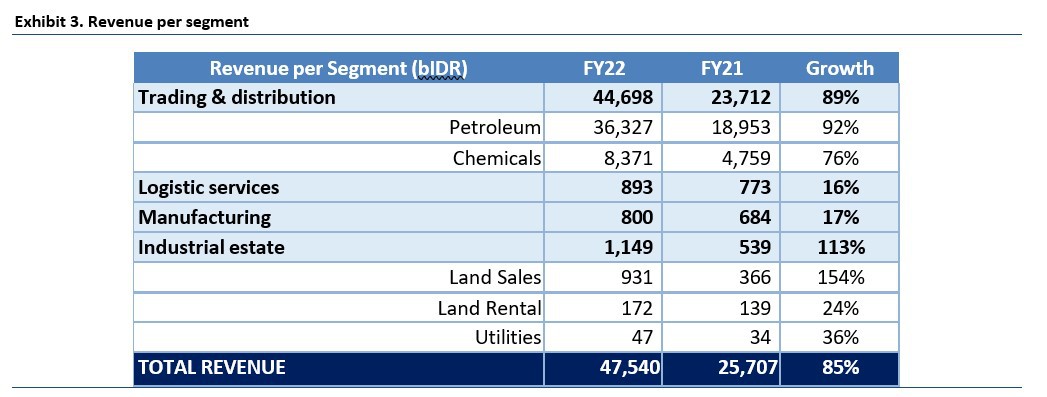

o Trading & distribution: increased 89% to Rp 44,698 Billion

o Industrial estate Segment: rose 113% to Rp 1,149 Billion

o Manufacturing segment: rose 17% to Rp 800 Billion

- Gross Profit FY 2022: Rp 4,252 billion increased 85%yoy – FY 2021 Gross Profit Rp 2,293 billion

- Net profit for the Year prior to Minority Interest FY 2022 recorded 118% growth to Rp 2,479 billion

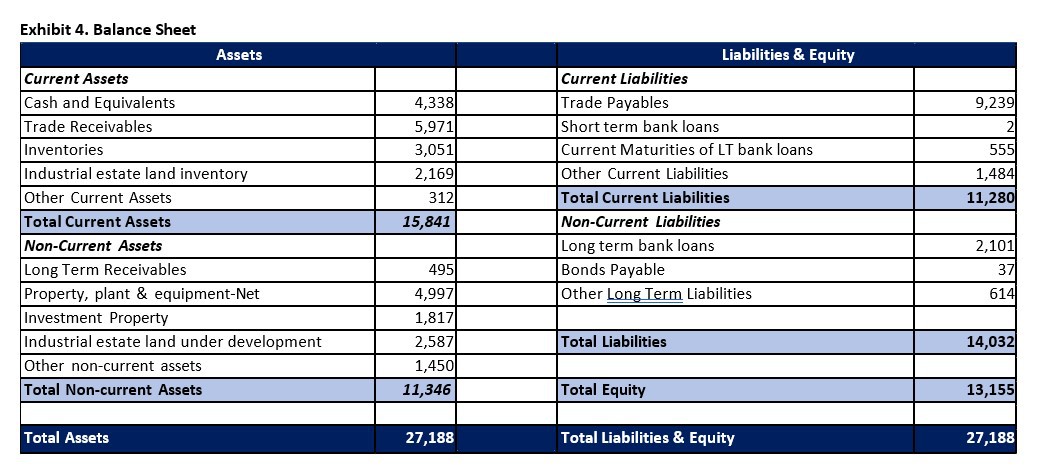

- Strong Balance Sheet:

o Total Assets as at 31st December 2022 Rp 27,188 billion (2021: Rp 23,509 billion)

o Total Equity as at 31st December 2022 Rp 13,155 billion (2021: Rp 11,299 billion)

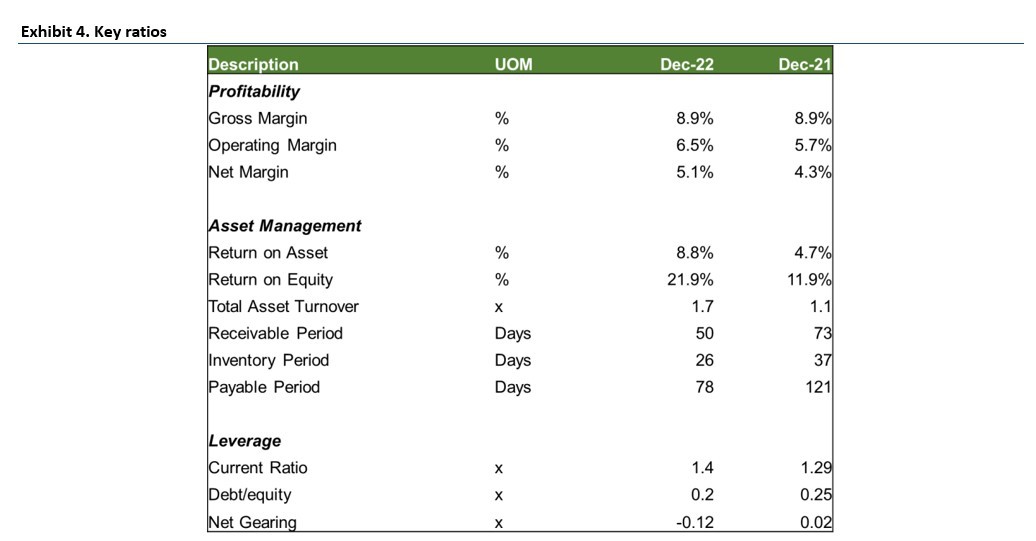

o Net Gearing of the company: Negative 0.12x – NET CASH POSITION

o Cash balance on 31st December 2022 – IDR 4,337 billion

Mr. Haryanto Adikoesoemo, President Director of AKRA commenting on the the Company's financial performance said, "We are extremely pleased to report excellent financial results for the year 2022, with strong growth in all our business segments amidst global supply chain disruptions and geopolitical conditions. AKR Petroleum and basic chemicals distribution ensured timely and efficient supplies of essential petroleum products and raw materials to industrial customers across the Indonesian archipelago supported by the extensive logistics and supply chain network of Ports, Storage terminals and transportation supported by innovations in the IT network.

Year 2022 was characterized by significant changes in the energy prices and basic chemical prices; AKR time tested business model of passing through these price movements to our customers while maintaining the gross margins enabled AKR to deliver a solid performance with Gross profit growing 85% to Rp 4,252 billion during FY 2022. We continued to maintain tight control on our costs and also improved efficiencies by investing in IT platforms to optimize movement of our fleet of trucks and ships and improve utilization”

“ AKR continued to generate strong cash flows during the FY 2022 with EBITDA of Rp 3,539 billion and with good working capital management were able to reduce the overall borrowings of the Company; the Company is in NET CASH position and we are extremely happy to receive an UPGRADE to our ratings from PEFINDO Indonesia’s leading rating agency which improved the Corporate and Bond rating of the company to id AA with stable outlook” said Haryanto.

“ SEZ - Java Integrated Industrial and Port Estate (SEZ- JIIPE) has become one of the strategic industrial estates in Indonesia and we are proud to Champion the manufacturing growth and attract valuable foreign investment into Indonesia; the largest integrated industrial and port estate being developed jointly with PELINDO, State owned Indonesian Port Corporation recorded land sales of 44.5 hectares during 2022 attracting international investors who have access to World class deep sea port, utilities and excellent connectivity; JIIPE is becoming a destination of various industries including the EV, Battery, Chemicals, glass and other heavy industry which benefit from the largest single line Copper Smelter and Precious metal refinery being built in our estate. With more heavy industry and other customers building their plants we are well poised to build a stable and growing recurring income for the Company in the coming years.” Haryanto added.

Revenue per segment – Business performance improved in all segments

The strong growth of FY22 earnings is driven by strong performance in all business segments of AKR, with growing contributions from Industrial Estate segment as AKR enjoys monetization from its long term investment in JIIPE. The trading and distribution revenue grew by 89%yoy driven by both petroleum and chemicals segment with growth in volume and higher Average Selling Price. Logistics and manufacturing also shows double digit growth. Significnat contribution also was recorded in our Industrial Estate business where the revenue is bolstered by land sales and lease rentals; during the year 2022 land sales of 44.5 ha was recorded exceeding our target.

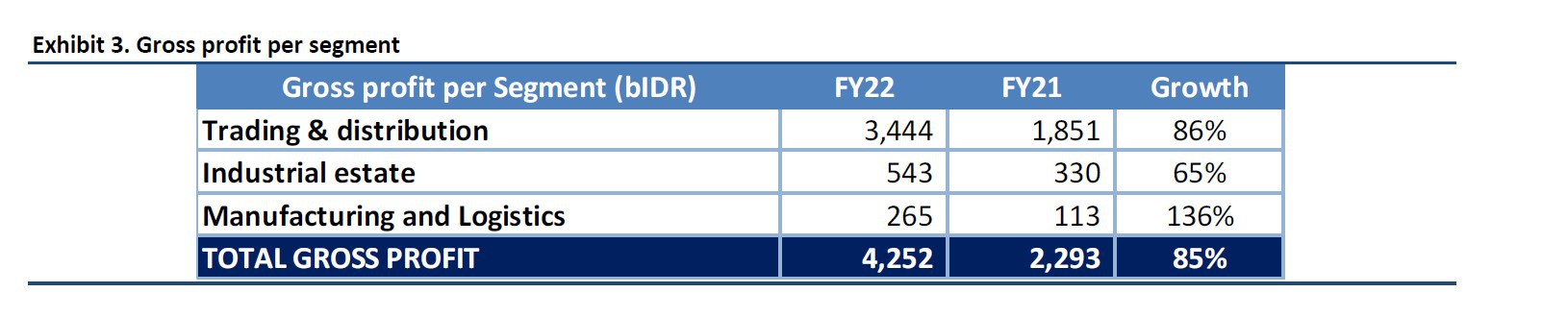

Gross Profits – Delivering GP growth of 85%yoy

Trading and distribution gross profit increased by 86% to Rp 3,444 billion. Industrial estate segment contributed 13% of the Consolidated gross profit and grew 65%yoy to Rp 543 billion during FY 2022; Manufacturing and logistics gross profits also grew during the FY 2022 by 136%yoy; Overall Gross Margin during the FY 2022 remains strong at 8.9% of Sales Revenue.

STRONG BALANCE SHEET WITH NET CASH POSITION: Significant reduction in Borrowings

AKR Balance sheet as at 31st December 2022 reflects a strong position with Total Assets of Rp 27,188 billion and Net Equity of Rp 13,155 billion; the key financial ratios of the Company continue to be solid and the Company has managed its working capital position very well and has Rp 4,388 billion or 16% of the total assets in Cash and Cash equivalents ensuring adequate liquidity and also ablity to fund its investments from internal cash resources.

Haryanto Adikoesoemo

President Director

PT AKR Corporindo