Commenting on the Financial results Mr. Haryanto Adikoesoemo, President Director of AKRA, said;

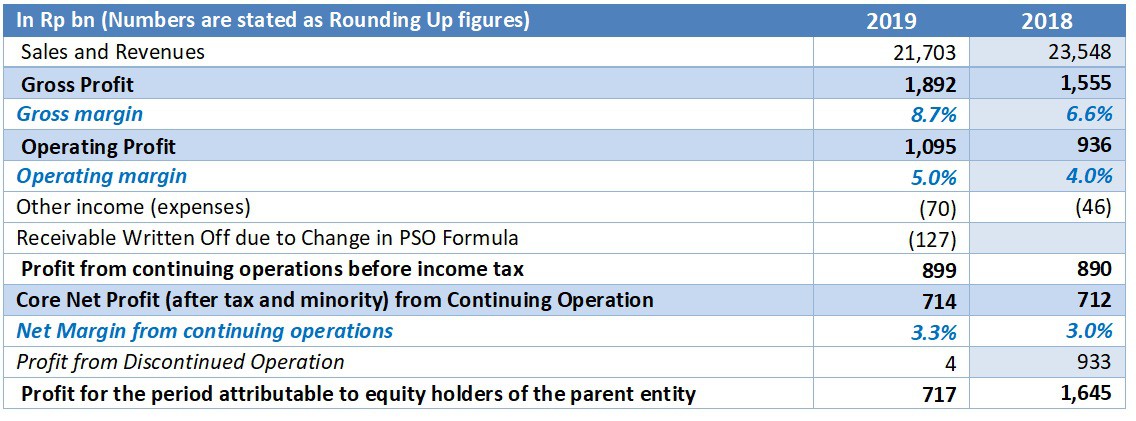

"We are extremely happy to report the audited financial results for year 2019 with improvement in the Gross Margins and Operating margins; despite the tough economic conditions the company could report a strong performance during the year 2019 with Core Net profit being maintained”.

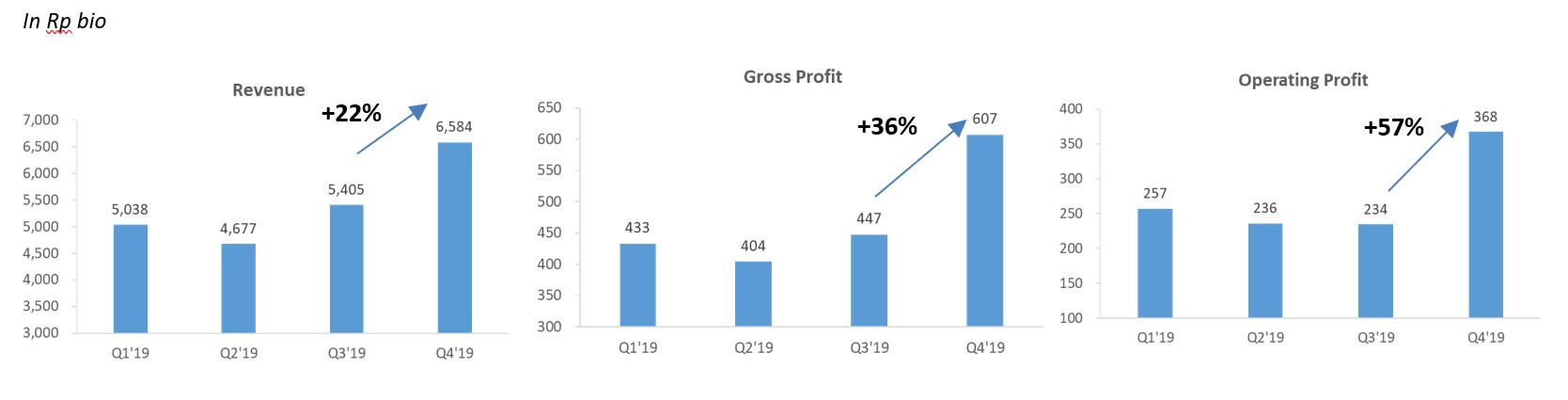

“AKR recorded Good Performance during 4Q19, with Gross Profit at highest level of Rp607 bn during 4Q19, Trading and Distribution segment contributed to this and was supplemented by JIIPE land sales and recognition of lease revenue. The strong Q4 momentum has been carried into Q1 2020. This gives us confidence that we will be able to sustain healthy sales growth in 2020 and maintain profitability and margins.” said Mr Haryanto

On the current Covid -19 situation and significant drop in Oil prices, Mr Haryanto assured “Our Management is closely monitoring impact of COVID19 to assess the demand slowdown, volatile prices and supply chain disruptions. AKR business model as distributor ensures effective Pass through of Oil and Chemical Price movements and does not carry any inventory loss risks. We have diversified sources of income and strong balance sheet, to minimize downside risks“.

On the medium to long term strategy to sustain growth he outlined as follows :

“Our investment focus in the last few years has been on expansion of logistics network, Petroleum retail, and diversification of earnings from Java Integrated Industrial Port Estate (JIIPE). A large portion of these investments have been funded from equity and JV partners, keeping our Net Gearing to below 30%, even with healthy dividend payout. Our strategy is aligned with government initiatives to boost domestic value addition and facilitate strong manufacturing base. The Investment and Diversification of revenue will significantly boost our Net Profit and Return on Equity”, said Mr. Haryanto.