PT AKR Corporindo (AKRA) delivers 20% Net Profit growth in 9M 2021

October 26, 2021

- Strong revenue growth driven by rising commodity prices and volumes

- Increasing contribution from Industrial Estate KEK-Gresik with agreements, with the anchor tenant

- Strong cashflows supporting high dividends and low financial charges

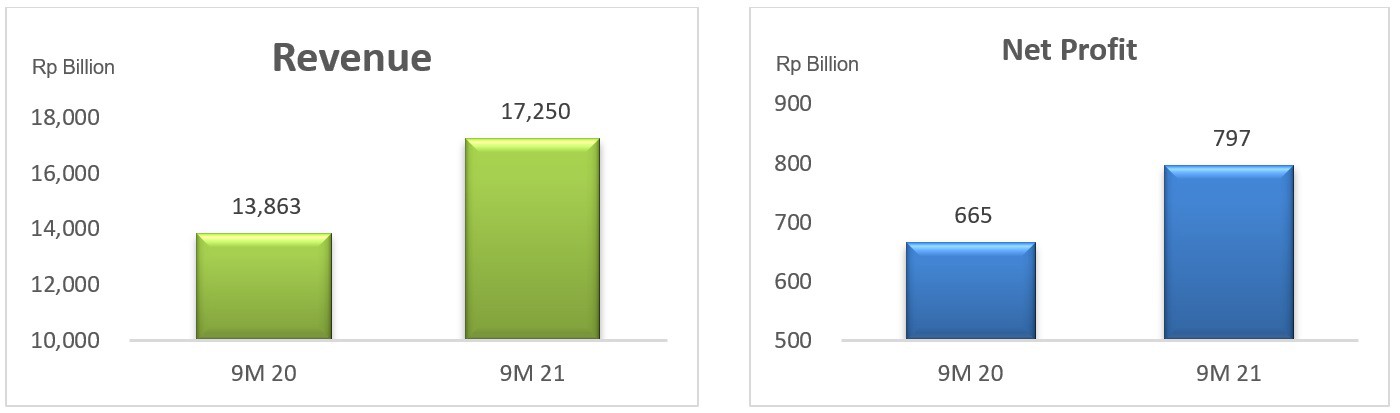

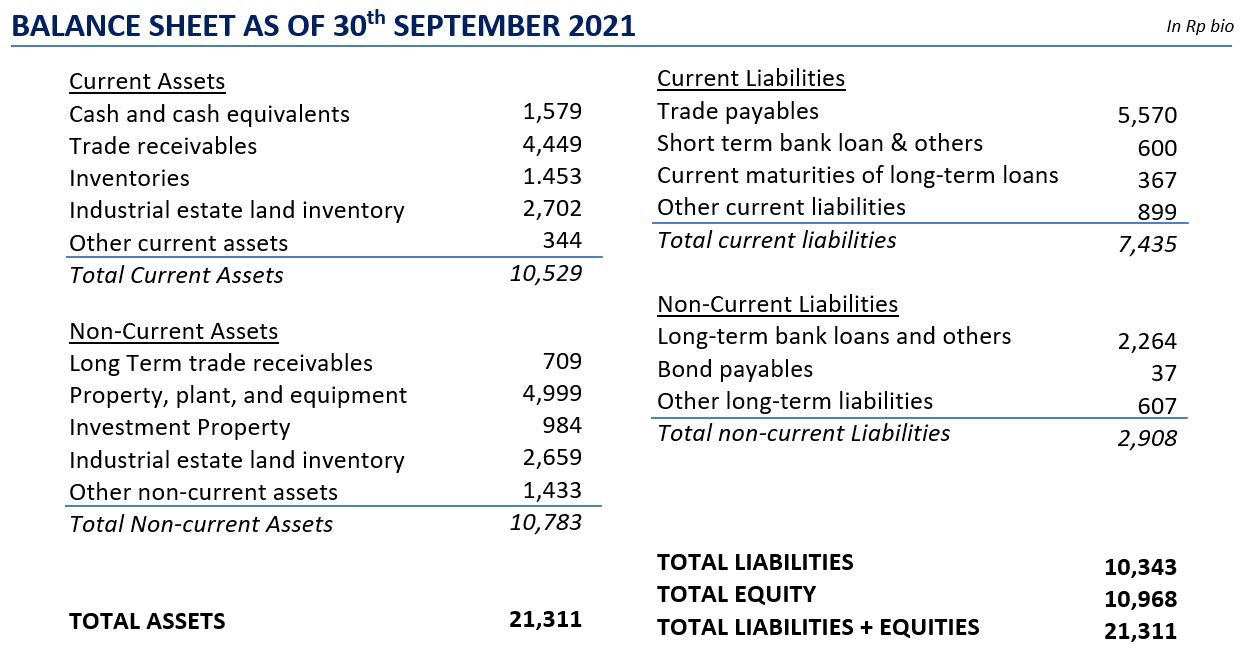

JAKARTA, October 26, 2021 – PT AKR Corporindo (AKRA) reported 9M 2021 Net Profit of Rp797bn, up 20% yoy. This profit growth is driven by Revenue growth of 24% and tight control over expenses. Cash generated from operations in 9M 2021 was Rp2trn, up 25% yoy. Balance sheet remains strong with Net gearing of only 0.15X.

CONSOLIDATED FINANCIAL STATEMENTS

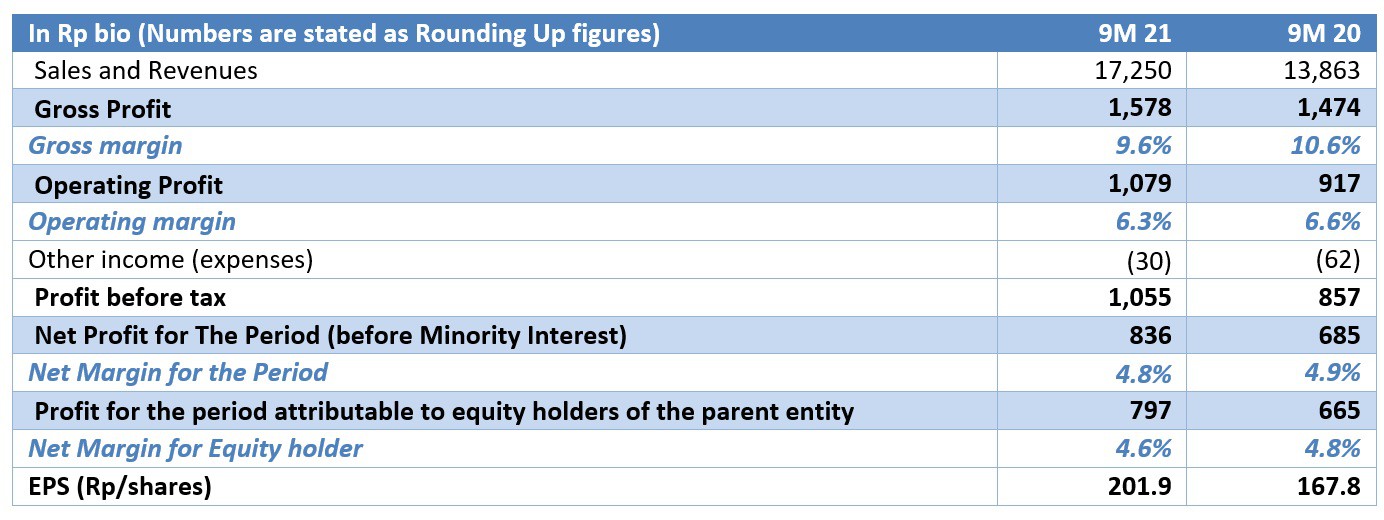

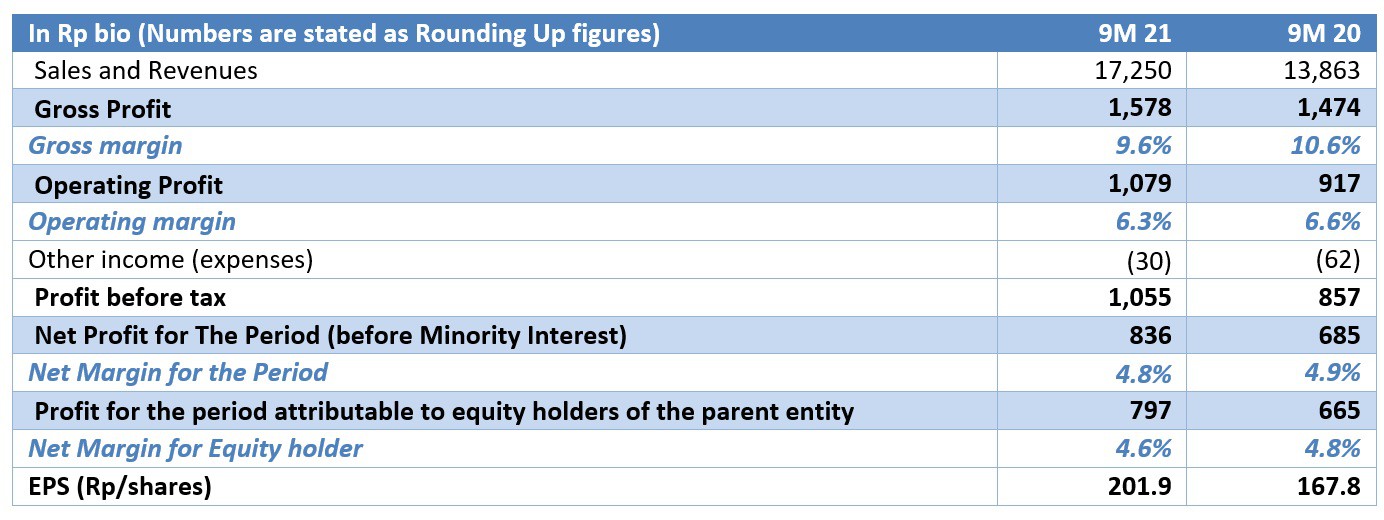

The Company reported the unaudited financial results for the nine months ended 30th September 2021 to Indonesian Stock Exchange today. Key highlights are

- AKRA's consolidated revenue for 9M 2021 grew by 24% to Rp17,250 billion,

- Operating profit grew 18% to Rp1,079 billion

- Net profit before minority grew 22% to reach Rp836 billion

- Net profit for parent entity of Rp797 billion and EPS grew by 20%

- Interim dividends for year 2021 of Rp237bn (Rp60/share) were paid on August 19, 2021.

Haryanto Adikoesoemo, President Director of AKRA stated, “AKRA has delivered strong revenue growth in Trading and Distribution business segment supported by volume growth, and higher commodity prices. Volumes in our petroleum and basic chemical distribution have been rising steadily since last many quarters with recovery in key customer segments and we are now experiencing higher selling prices. We continue to maintain margins while ensuring disciplined Net open position management. Meanwhile, have tightly controlled our expenses, increased productivity, and maintained low net gearing.”

“Industrial estate division (JIIPE Gresik SEZ) recorded higher contribution during the year with several positive developments; JIIPE Gresik SEZ has been attracting more investors and has recently signed long term agreements for lease of land and supporting infrastructure and services with our anchor tenant who is constructing copper smelter and precious metal refinery. This has both increased and diversified our sources of income.”

“We are optimistic of maintaining strong performance in the coming quarter. JIIPE Gresik SEZ recently had visit by President of RI Joko Widodo, accompanied by East Java Governor and key Cabinet Ministers. During this visit, government has committed to support KEK-JIIPE Gresik in attracting more investments. With our KEK status and inauguration of Development and Management Entity (BUPP), KEK-JIIPE offers multiple tax benefits and ease of doing business, making it one of the most attractive Industrial Estates in the region. We are experiencing rising number of investor inquiries from both foreign and domestic investors that will translate into future land sales,” said Haryanto.

AKRA also expects positive impact of rising commodity price cycle, “The global economy is currently experiencing tight supply of key commodities, resulting in sharp increase in prices. Indonesia is one of the countries that will benefit from this. AKR anticipates higher demand of energy and chemicals from our customers. With our dependable logistic infrastructure and product procurement sources, we will ensure that we meet this rising demand, while optimizing profitability for our shareholders,” he added.

Haryanto Adikoesoemo

President Director

PT AKR Corporindo Tbk

→

Download