PT AKR Corporindo Tbk delivers Net Profit for the year 2021 Rp 1,112 billion- 20% Net Profit growth YoY

March 22, 2022

JAKARTA, March 22, 2022 – PT AKR Corporindo Tbk (AKRA) leading distributor of Petroleum and basic chemicals and provider of logistics and supply chain solutions reported Net Profit of Rp 1,112 billion during the year 2021 growing 20% yoy.

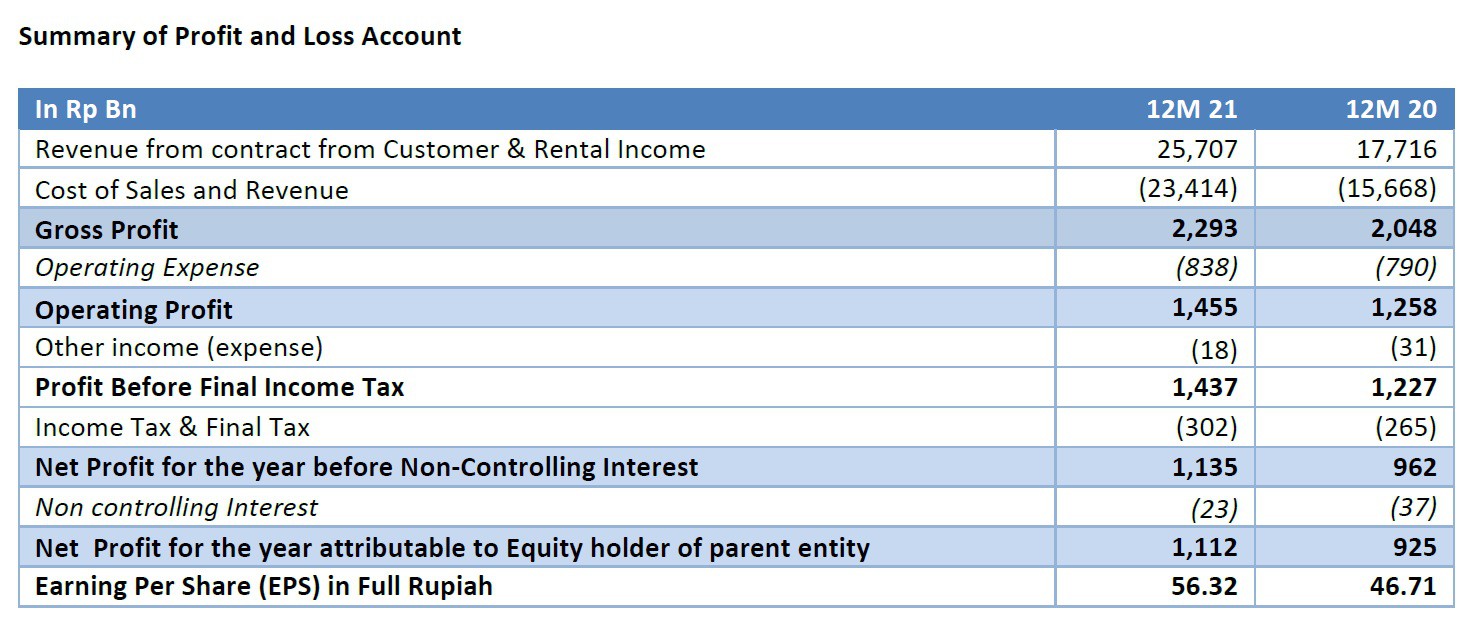

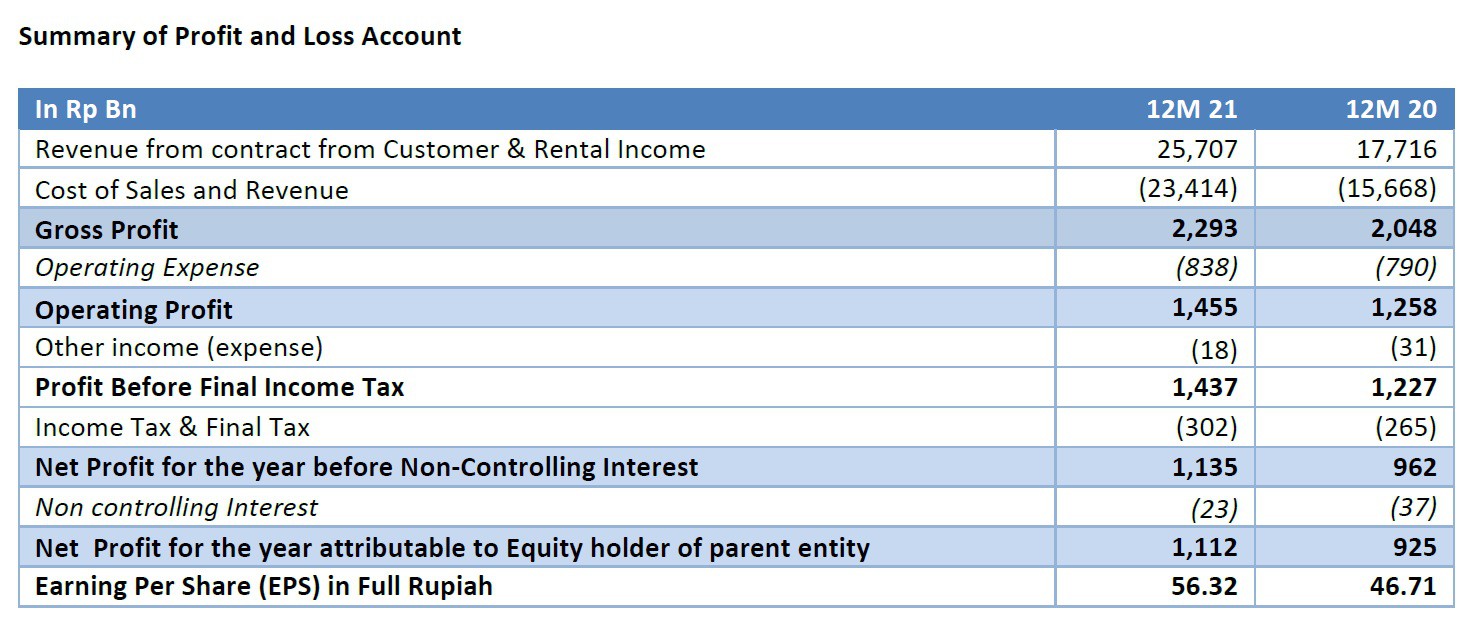

The Company today filed the financial results audited by Purwantono, Sungkoro & Surja, a member firm of Ernst & Young with a clean opinion with the Indonesian stock exchange. AKRA continued to deliver strong results during the year 2021 following the 30% Net profit growth during the previous year. AKRA Sales revenue during the year 2021 grew 45% yoy to Rp 25,707 billion with growth in volume of trading and distribution business along with higher selling prices for Petroleum and basic chemicals distributed

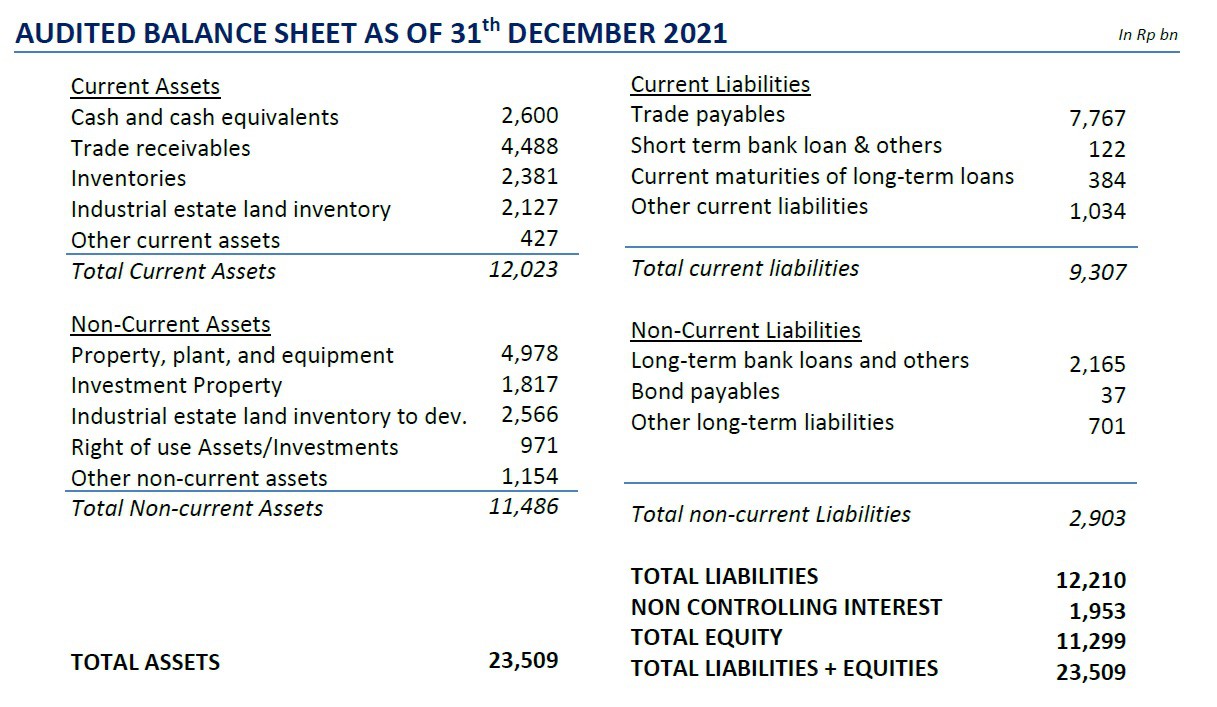

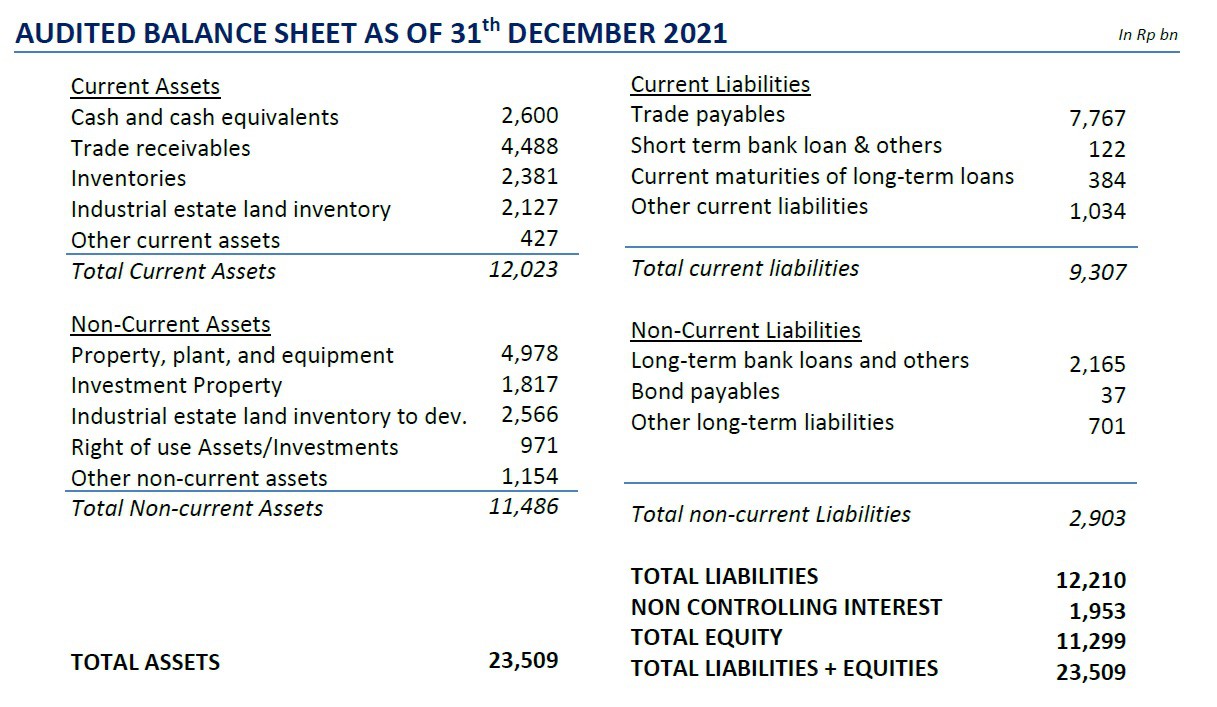

The company also generated strong Net Operating Cashflow of Rp 2,945 billion which was used to reduce loans and also fund its ongoing capital investments while maintaining high dividend payments to its shareholders.

Key Financial Highlights of Performance during 2021

Commenting on the financial results, Haryanto Adikoesoemo, President Director of AKRA stated, “I am extremely pleased to announce that AKR Corporindo has delivered another year of growth during the year 2021. In 2 years of COVID19, our Net Profit has increased by cumulative 55%. AKRA could deliver this strong result despite the various challenges faced due to COVID pandemic and global supply chain disruptions when countries reopened their economies. We continue to deliver basic chemicals, petroleum and logistics services to our customers across the Indonesian archipelago without any disruptions. We continue to innovate and leverage our Information technology platform to enable our operations to function smoothly.”

“The year 2021 was also characterized by increase in petroleum and chemical prices; the ongoing geopolitical conditions have resulted in extremely volatility in the Energy and commodity prices; AKRA continued to deliver performance in these tough times, this proved the resilience of our business model. AKRA’s time tested business model enables us to pass through the price increases to our customers while maintaining our margins by improving efficiencies.”

Strong growth in Basic Chemicals & Petroleum distribution to Industrial customers; increased contribution from JIIPE

The Company delivered strong growth in Volumes of basic chemicals and petroleum products; demand for basic chemicals grew in Smelters, Rayon industry and other sectors; Petroleum supplies to mining, plantation and other sectors increased during the year and the company ensured uninterrupted supplies.

Java Integrated Industrial and Ports Estate (JIIPE), Gresik East Java, also contributed to growth to the financial performance during the year 2021; Revenue of JIIPE grew by 69% to Rp 539 billion, from land sales, utilities and lease rentals; JIIPE which has been designated as Special Economic Zone with the concept of providing Multi modal transport facilities along with various fiscal and Non-fiscal benefits and is poised to be the destination of choice for domestic and foreign companies.

Strong Balance Sheet with very low Net Gearing

AKRA reported a strong balance sheet with Total assets of Rp 23,509 billion with a cash balance of Rp 2,600 billion as at 31st December 2021; the company reported significant reduction in its borrowings during the year 2021 and Net gearing reduced to 0.02X.

AKRA committed to implementing best ESG practices:

“We are committed to grow the business in a sustainable manner and also the planning the transition to the green and clean energy. We are also investing in Gas, renewable energy and along with our partner bp investing in a world class retail network. JIIPE has a large potential to produce power from renewables and our first project for installation of solar panels has been completed. AKRA is committed to protect the health and safety of our employees and environment with strict and safe operating standards; we are committed to serve the communities in the areas our operations are located and also support the Indonesian government efforts to attract investments by providing efficient logistics, supply chain and a world class Integrated Industrial estate in JIIPE Gresik.” said Haryanto.

Outlook for 2022

Expressing his optimism for Mr Haryanto said “demand for trading and distribution products continues to be strong; Indonesian mining and plantation sector continues to grow with better commodity prices; we expect the demand for petroleum products to rise; demand for basic chemicals is also expected to be strong during the year 2022; JIIPE is seeing good interest for industrial land and utilities and our marketing teams are in discussion with many interested tenants; overall we expect to maintain growth in the Company’s business”

The audited financial statements of the company filed with IDX today are available for download from the company’s website : www.akr.co.id

Corporate Secretary

PT.AKR Corporindo Tbk.

→

Download