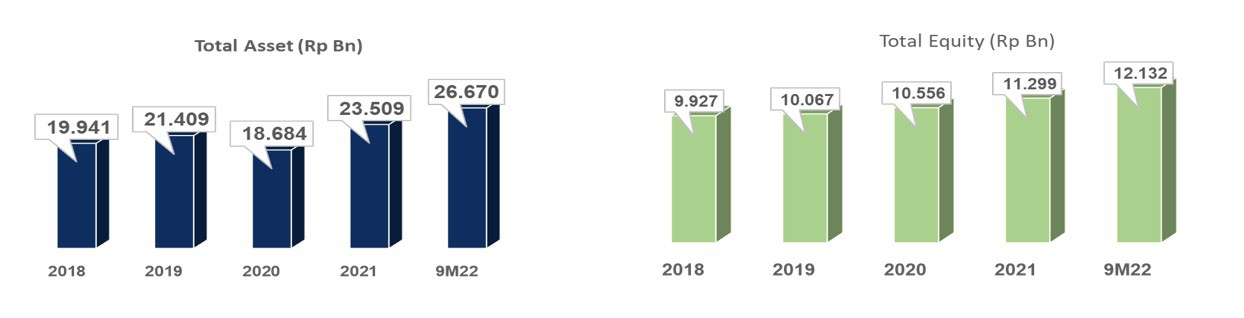

Maintained Cash Flow, Strong Balance Sheet

Cash flow from operating actives during the 9M 2022 reached Rp. 3,737 billion which was utilised by the Company not only for capital expenditure, land acquisition for JIIPE, payment of taxes but also pay a significant cash dividend of Rp 829 billion to the Shareholders by way of final dividend for 2021 and Interim dividend for the year 2022.

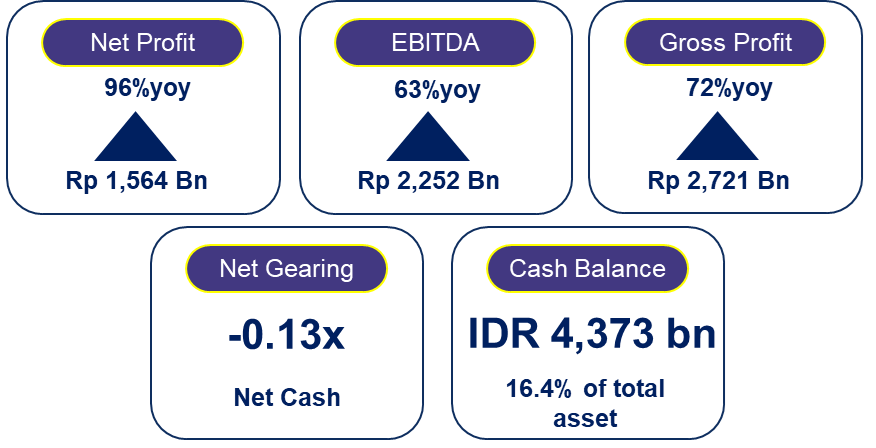

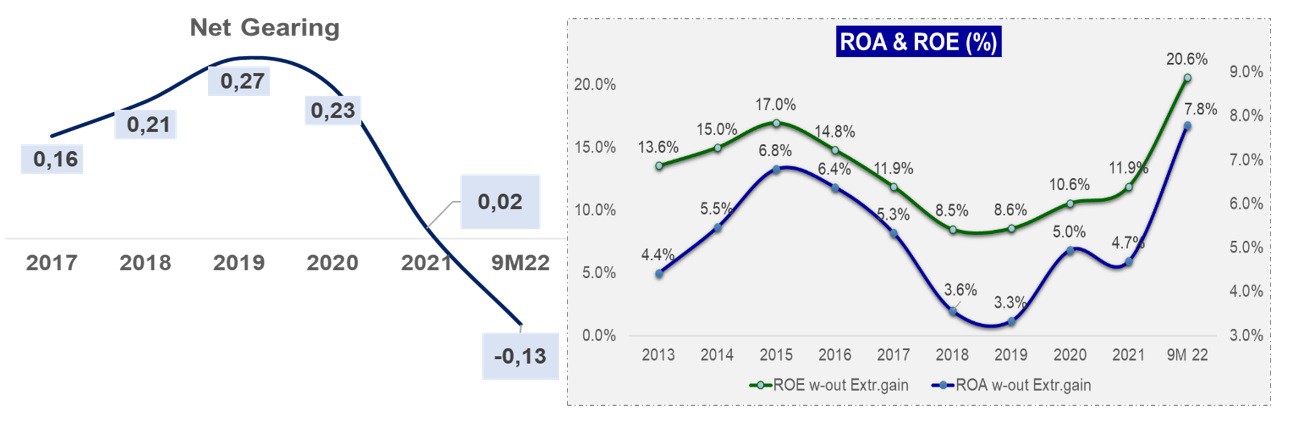

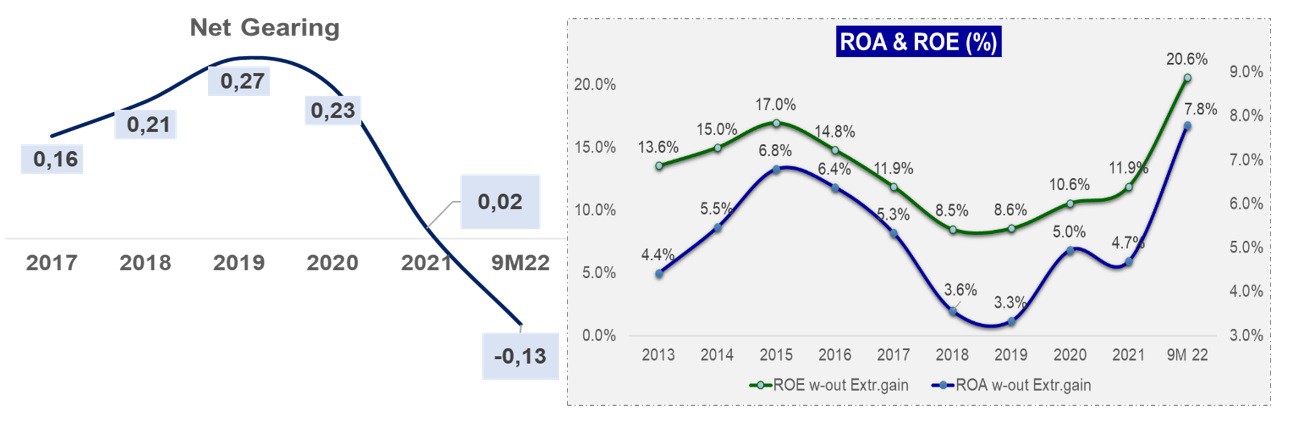

The Company's reported further improvement in key financial ratios; Return on Equity increased significantly to 20.6% and Return on Assets to 7.8%; with very healthy working capital ratios

Mr Haryanto commenting on the prospects and outlook for the year 2022 said, “ Demand for basic chemicals and petroleum products distributed by the Company to various sectors of the economy including manufacturing, mining, bunker, transportation sectors continues to see increased demand with the Indonesian economy continuing to show growth; demand for minerals such as nickel, bauxite, copper and also coal mined in Indonesia is increasing with the current geo political conditions and focus on renewable energy; the Company sees good growth prospects and we are confident of meeting or exceeding our targets for this year”

“ JIIPE project is seeing good demand from foreign and domestic investors and we are seeing good prospects for land sales from the large land bank ready for sale but also we are targeting those investors who have requirement for Port , large utility requirement which should drive the recurring income of the Company; overall we see these developments enable the company to monetize the assets in JIIPE while contributing to the overall growth in the investments in the Country”

Corporate Secretary

PT AKR Corporindo Tbk