AKRA Posted Net Profit of Rp 202 bn in 1Q19, with Improved Margins

April 26, 2019

JAKARTA, 26 April 2019 – PT AKR Corporindo Tbk (IDX ticker code: AKRA.IJ), distributor of Petroleum, Basic chemicals and provider of Logistic & supply chain services in Indonesia reported revenue of Rp 5,038 bn and net profit attributable to equity holders of parent entity of Rp202 bn in 1Q 2019. The unaudited financial results for the quarter ended 31st March 2019 was filed with the Indonesian Stock Exchange today.

HIGHLIGHTS

- Core Net Profit without extraordinary gain during Q1 2019 is Rp202 bn compared to Rp 200 bn in Q1 2018. During Q1 2018, the Company booked extraordinary gain from divestment of Rp 729 bn.

- Revenue was lower due to lower selling price for Petroleum Products in line with declining oil price in Q1 2019, also basic chemical prices declined but volume outlook remains good with improving economic growth.

- Margins improvement: Gross Margin improved in Q1 2019 to 8.6% from 7.1% in Q1 2018, and operating margin improved to 5.1% in Q1 2019 from 4.1% in Q1 2018.

- Company exercised cost control with G&A and selling expenses were sustained at same level compared to the same period last year.

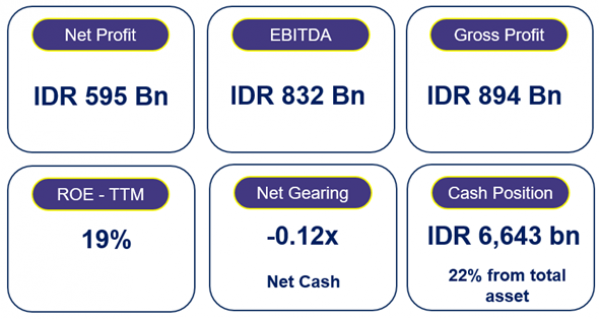

- Balance sheet remains strong as of 31 March 2019, as net gearing stood at low 0.27x.

In Annual Report, President Director of AKRA, Mr. Haryanto Adikoesoemo, stated;

" In 2018, AKR focused on the transformation process that has been carrying out since 2017. A range of improvements related to work process, human capital and information technology are continuously made and enhanced. Moreover, since 2017, the Company has focused on developing business potential within the country. AKR achieved outstanding performance in 2018 by implementing portfolio reconsolidation, logistic infrastructure expansion, strategic partnership with BP, and developing recurring income from JIIPE. The company is optimistic to enter 2019, considering the positive economy outlook for Indonesia. Additional terminal capacity and retail network expansion for AKR and BP-AKR petrol stations will become factors in supporting sales growth of trading distribution segment. Positive outlook for industrial sector in Indonesia will also lead to improvement in JIIPE Industrial Estate sales. It is expected that with completion of facilities and utilities, JIIPE will become one of the top choice for companies in industrial sector”.

→

Download