AKRA Net Profit FY 2023 IDR 2.78 Trillion, up 16%YoY Earnings boosted by strong performance in Industrial estate Segment

March 21, 2024

JAKARTA, March 21, 2024 - PT AKR Corporindo Tbk., (AKRA:IJ) released the Audited Consolidated Financial results for the Financial Year ended December 31, 2023 to the Indonesia Stock Exchange and the Financial Services Authority today.

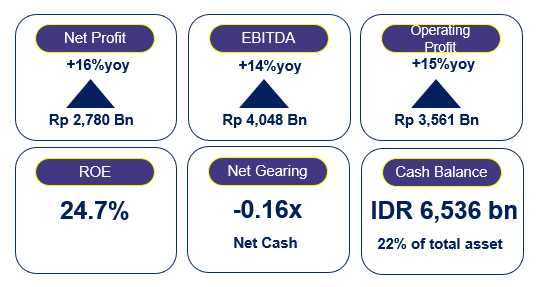

Key Performance Highlights for FY 2023

Highlights:

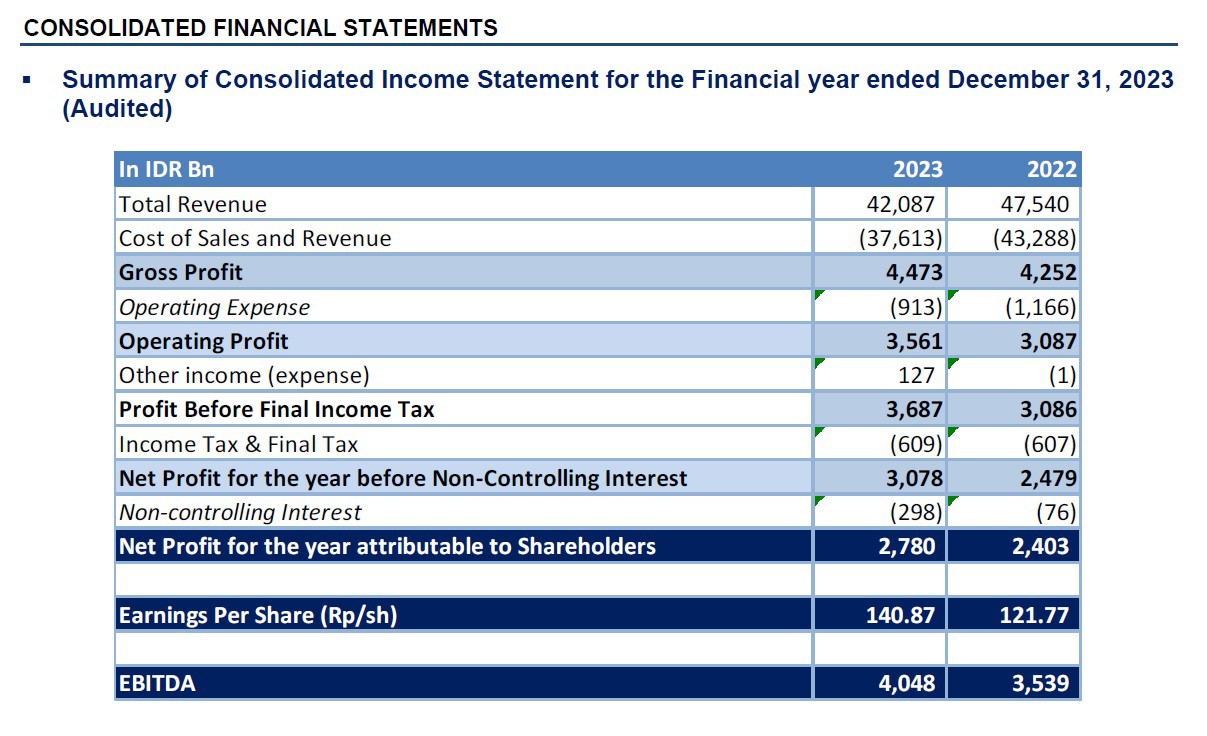

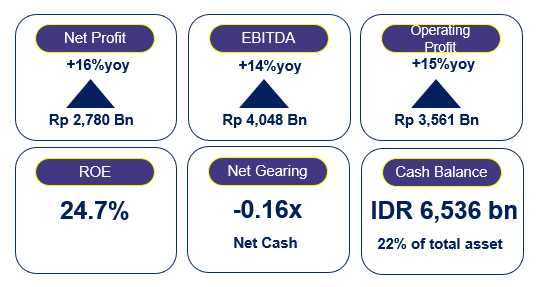

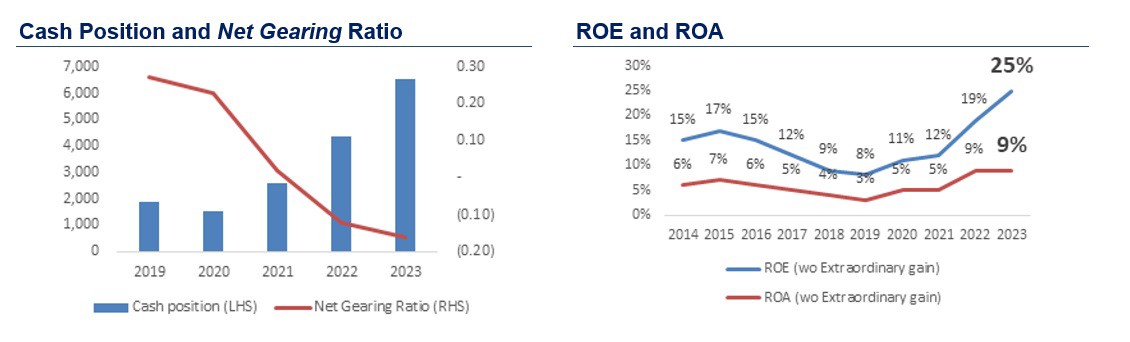

- AKRA reported 16%yoy growth in Net Profit attributable to equity holders for FY 2023 of IDR 2,780 Billion compared to IDR 2,403 Billion in FY 2022. The company recorded CAGR of 31% over the past 5 years.

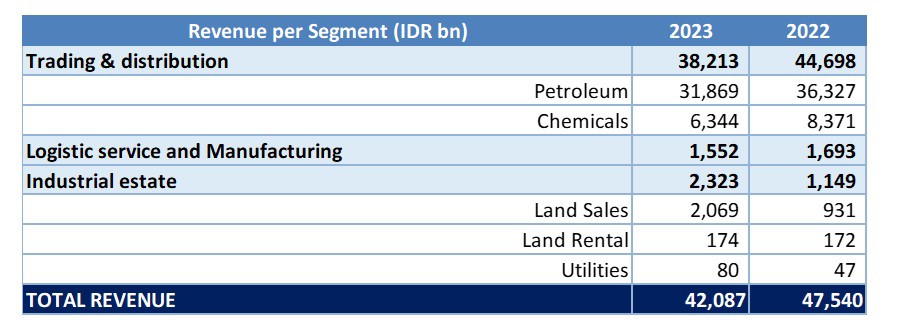

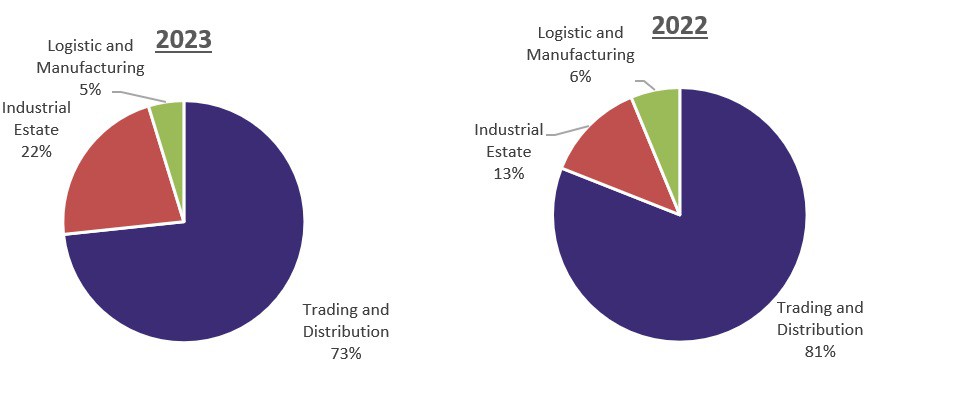

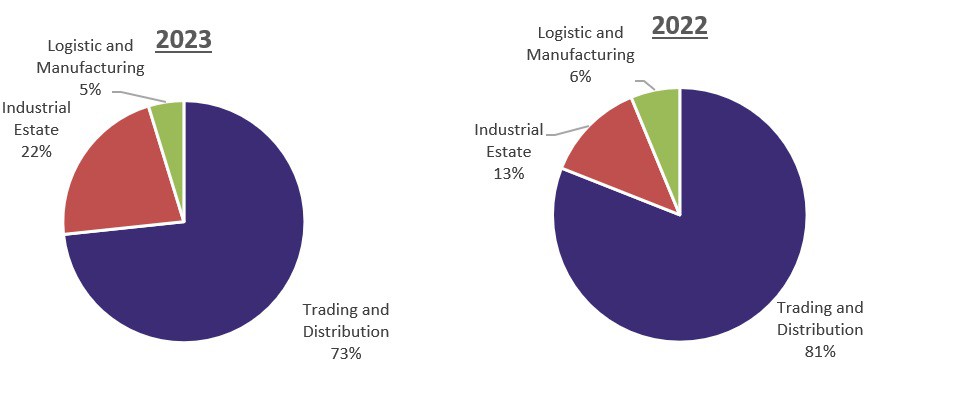

- Revenue from the Industrial Estate segment grew 2x in 2023 reaching IDR 2,323 billion, driven by growth in land sales of 91Ha and recurring income for utilities. The contribution of Industrial Estate to AKRA's consolidated gross profit also increased by 22%, higher than 13% in 2022. Gross Profit from Industrial land sales, rental income and utilities in 2023 was IDR 981 billion.

- EBITDA grew by 14% in FY 2023 to IDR 4,048 billion compared to IDR 3,539 billion in 2022

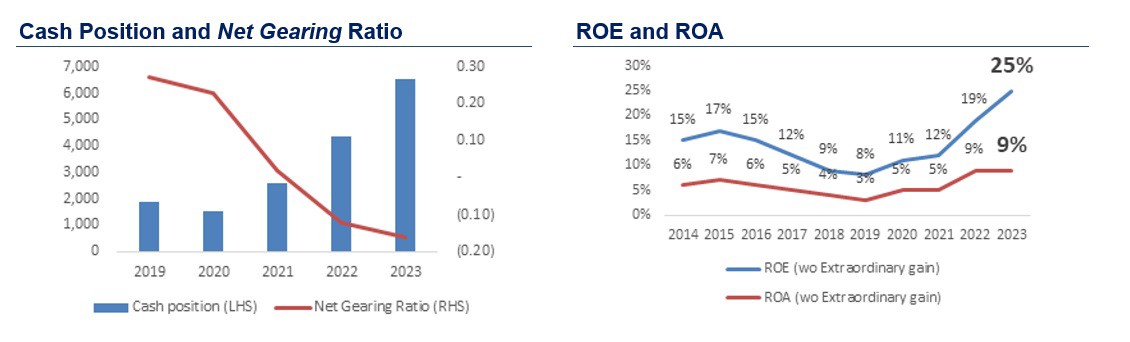

- Strong performance resulted in significant improvement in ROE 24.7% and ROA 9.2%.

- The Company continues to maintain operational efficiency whereby Operating Expenses reduced by 14% to Rp 975 Billion during FY 2023

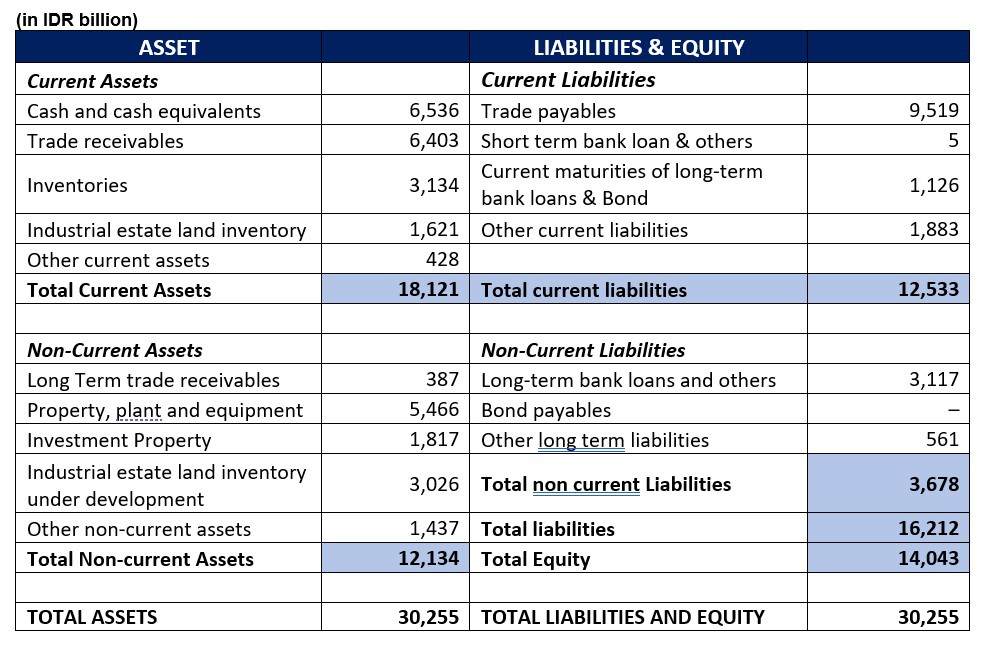

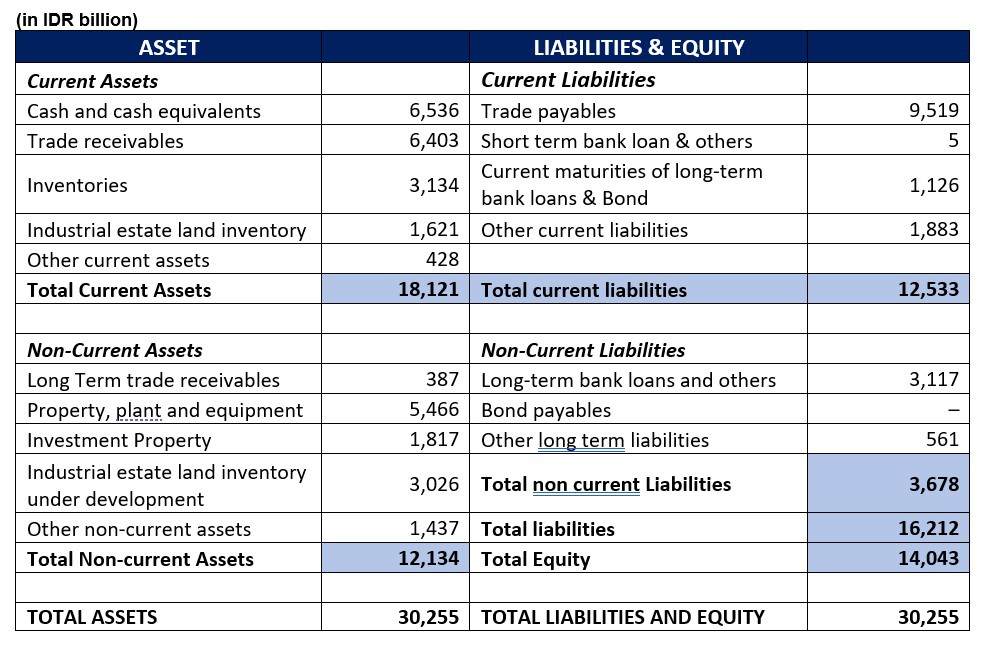

- The Company reported a strong Balance Sheet position with Total assets of IDR 30,255 billion as of December 31, 2023 while maintaining a low Debt-to-Equity ratio at 0.3x.

- Cash position as of December 31, 2023 reached IDR 6,536 billion, higher by 51% compared to December 31, 2022. The Company remains in Net Cash Position with Net gearing ratio at -0.16x at the end of FY 2023.

President Director of AKRA, Mr. Haryanto Adikoesoemo, in his statement:

" We are extremely happy to report a Strong performance during the year 2023 with growth in Net Profit by 16% YoY reaching IDR 2,780 billion. The Company has continued to sustain it growth momentum with growth driven not only by the Core business sectors of Trading and distribution and logistics but also with a significant contribution from the Industrial Estate Segment; during the year FY 2023 JIIPE Special Economic Zone in Gresik recorded significant land sales to International companies.”

“The Company continued to improve operational efficiencies resulting in significant cost reduction and reported strong operational cash flows. EBITDA also grew by 14% to Rp 4,048 billion which enabled the company to fund its expansions while paying out significant Interim dividends to its Shareholders. The Company has further improved its Return on Equity to 24.7% during FY 2023 and Return on Assets improved to 9.2% driven by the Strong financial performance".

“Trading and distribution of Petroleum and Basic chemicals continued to grow driven by increasing demand in Eastern Indonesia wherein the downstreaming of minerals resulted in higher mining and processing activity; to further address this market, AKRA is investing in logistics and supply chain infrastructure comprising of Storage terminals, Ships and improving its Information technology platforms”

“The Company's investment in the Special Economic Zone JIIPE in Gresik, East Java (SEZ JIIPE Gresik), has started to yield significant results. We are happy to report that land sales during the year 2023 reached 91 hectares higher than 44 hectares during FY 2022; SEZ JIIPE Gresik with its integrated port, industrial estates and utilities continues to attract international and domestic investors who are invested in value-added chain ecosystem in SEZ JIIPE which is supporting national industrial growth." said Mr Haryanto.

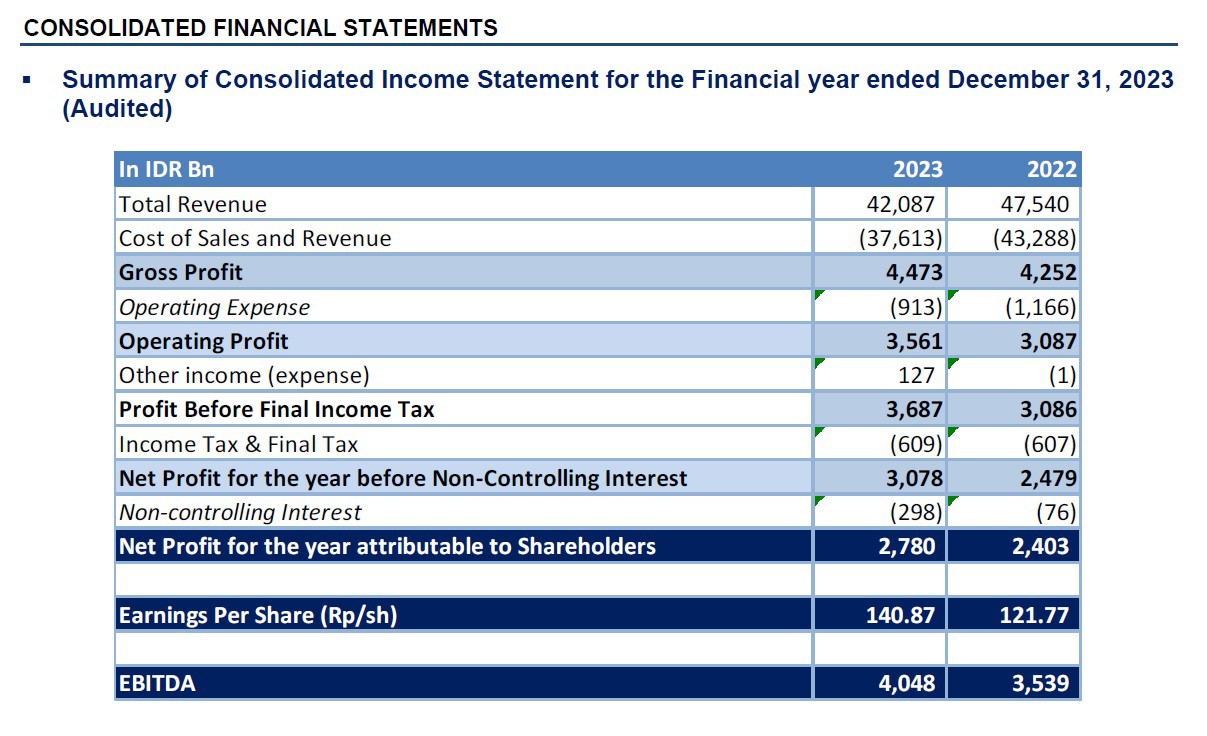

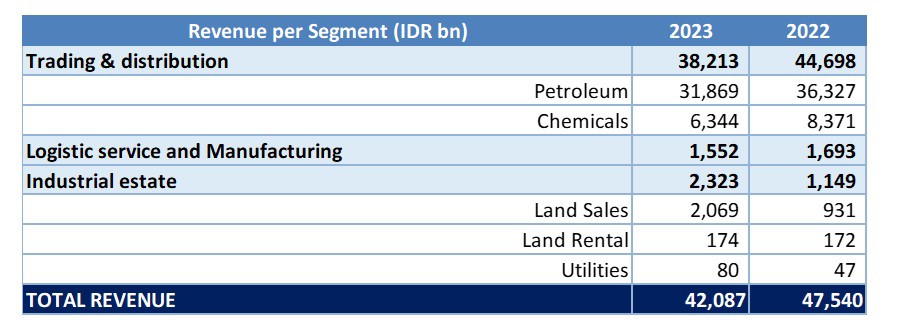

Segment wise Performance

Consolidated revenue during FY 2023 is Rp 42,087 billion; Revenue from Trading and distribution is Rp 38,213 billion lower than Rp 44,698 billion due to the lower Selling prices during the year with normalization of International price of Petroleum and basic chemicals; the Company continued to effectively pass through the price movements while increasing its Volume and maintaining the margins

Revenue from Industrial estate segment increased by 102% with higher land sales and increasing contribution from the utilities segment

Consolidated Gross Profit FY2023 was recorded at IDR 4,473 billion with higher contribution from Industrial Estate segment. Trading & distribution, logistics and manufacturing segment contributed 78% to the Gross Profit while the Industrial Estate segment contribution significantly increased to 22% during FY 2022 compared to 13% during FY 2022; The Gross profit of Industrial estate segment grew by 81% YoY to reach IDR 981 billion. Consolidated Gross Profit margin during 2023 improved to 11%, compared to 9% in 2022.

Balance Sheet

The Company's total assets as of December 31, 2023, increased by 11%, recorded at IDR 30,255 billion compared to IDR 27,188 billion last year. During the year FY 2023 the company recorded addition of IDR 933 billion to the Fixed Assets compared to IDR 293 billion during FY 2022. The Company invested in expansion of its fleet of Ships, investments in Storage terminals, retail outlets and other equipments;

Total Asset growth is also attributable to a 51% increase in Cash and Cash Equivalents; as at 31st December 2023 the Company reported cash balance of Rp 6,536 billion compared to Rp 4,338 billion at the end of the previous year.

Total liabilities increased by 16% to IDR 16,212 billion in 2023 from IDR 14,033 billion in 2022, mainly comprising of trade payables and additional bank loans obtaining by its industrial estate subsidiary; The Company continues to main very healthy working capital ratios with Current ratio of 1.4x while mainting a NET Cash position with net gearing of -0.16x.

On March 13, 2024, PEFINDO reaffirmed the rating of the Company's bond at idAA with STABLE outlook given the strength of the Company’s logistics and supply chain infrastructure and potential to increase recurring income from its Industrial estate segment.

The Company's Total Equity increased by 7% to IDR 14,043 billion as of December 31, 2023, compared to IDR 13,155 billion last year.

Corporate Secretary

PT AKR Corporindo Tbk

→

Download