AKRA 6M 2023 Net Profit Rp 1,031 billion - Grew 8% YOY with higher contribution from Industrial estate segment

July 26, 2023

JAKARTA,

July 26, 2023 – PT AKR Corporindo Tbk (AKRA) reported Net Profit attributable

to Equity holders of Rp 1,031 Billion for the 6 month period ended June 30, 2023

compared to Rp 955 Billion during 6M 2022 registering a 8% yoy growth. The

Company reported Consolidated Sales revenue of Rp 19,855 billion during the 6 months

ended 30th June 2023 lower than same period during the previous year

due to lower selling prices in line with reduction in Petroleum and chemical

prices.

Gross

profit of the Company increased 12% to Rp 1,810 billion and the company

delivered EBITDA of Rp 1,604 billion 13% higher than same period last year.

AKRA

continues to maintain a strong balance sheet during 6M 2023, with total assets

of Rp 25,430 billion with very healthy financial ratios; Current ratio of the

Company improved to 1.8x and Return of Equity during this period is reported at

18.8%. The Company continues to maintain very low debt levels and adequate cash

balances.

Key Performance Highlights for 6M 2023

Key

Highlights:

-

Breakdown of Sales Revenue - 6M 2023:

o

Trading & distribution: Rp 18,477 Billion

o

Industrial estate Segment: Rp 613

Billion

o Manufacturing

and logistic segment: Rp 764 Billion

-

Strong Balance Sheet:

o

Total Assets as at 30th June 2023 Rp 25,430 billion (6M

2022: Rp 27,834 billion)

o

Total Equity as at 30th June 2023 Rp 13,284 billion (6M

2022: Rp 11,992 billion)

o

Current ratio of the company: 1.8x higher compared to Q4 2022

(1.4x)

o

Net Gearing of the company:

-0.01x

o

Cash balance on 30th June 2023 – Rp 4,574 billion.

CONSOLIDATED FINANCIAL

STATEMENT

Summary of Profit and Loss Account For the Six Months Period Ended 30th June 2023 (Unaudited)

Revenue per

segment – consistent growth with higher traction from industrial estate

Total Revenue druing

6M 2023 was lower due to lower average selling prices – the Company passes all

the price movement in Petroleum products using formula based on MOPS and basic chemicals prices were lower during

the 1st semester of 2023 after recording high levels during the past

year due to improving supplies

Industrial land

segment recorded revenue of Rp 613 billion during the 6M 2023 higher than Rp

151 billion during the same period last year;

this includes sale of land to large Chinese company Hailiang which

started construction of Copper sheet factory which was inaugurated by

Indonesian President this quarter and also the lease rentals for the Copper

Smelter being built in JIIPE

Revenue per segment

Gross

Profits – Higher contribution from Industrial Estate segment

The

consolidated gross profit in 6M23 reached Rp 1,810 billion or improved by 12%

with significant improvement from Industrial Estate segment. The Industrial

Estate segment grew by 126%yoy to Rp 324 billion which also contributes 18% to consolidated

gross profit improved from 9% in 6M 2022. Overall Gross Margin during the 6M

2023 improved to 9.1% of Sales Revenue from 7.3% in 6M 2022.

Gross profit per segment

CEO Message

Mr. Haryanto

Adikoesoemo, President Director commenting on the results mentioned, “ We are

happy to announce financial results for 6 months ended 30th June

2023; AKR consistently deliver strong performance across all economic cycles

supported by extensive logistics and supply chain infrastructure and

disciplined supply chain management strategy. AKR has succeeded in delivering

products to meet customer demand in timely manner despite the global disruptions and supply chain issues.”

“AKRA reported a

net profit of IDR 1,031 bn during 6M 2023 higher by 8% compared to IDR 955bn in

6M22. This growth is supported by trading and distribution business segment which

has delivered despite global chain disruption and higher contribution from

JIIPE from booking of land sales in 6M23 also contributed to the growth. We

believe the portfolio of business is resilient and deliver across all economic

cycles.”

“AKRA has consistently

maintained stringent working capital management in the middle of rising

interest rate environment and market uncertainty leading to a leaner balance

sheet.

The government

plan of downstream and manufacturing and rising foreign direct investment

development in Indonesia has become engine growth for Indonesia and AKR as

well. We believe this will provide ample room for growth for use of petroleum

and chemical across sectors. The AKR retail JV, bp AKR posted higher sales

volume growth of and has currently rolled out 41 of retail outlets.”

“Furthermore, our

industrial estate business segment (JIIPE) has gained more traction since the

Special Economic Zone has been operational since end of 2022, recording more

inquiries from overseas and domestic interests Special Economic Zone provides

fiscal and non fiscal benefit which will be very beneficial to future tenants

of JIIPE. JIIPE along with strategic location offers direct port access and world

class utilities to serve tenants. With the largest smelter in the world

expected to be operational in Mid 2024, JIIPE is creating an ecosystem for copper,

chemicals and related industries. The immense requirements of utilities will be

served by JIIPE and will provide a significant recurring income in the future.”

“In 6M23 JIIPE has booked 19.6HA of accounting

sales from a prestigous copper foil manufacturer, PT Hailiang Nova Material Indonesia. JIIPE

also secured a marketing land sales in 2Q23. To realize the development of land

and utility facilities, JIIPE obtained an IDR 2.5tn credit facility from bank

BNI of which IDR 2.0tn has been drawn down. We continue to intensively market

Land and utilities which has enabled us to finalise land sales and utilities

contracts with international companies. We believe the mix of investment will

provide strong and consistent growth to the shareholders.”

STRONG BALANCE

SHEET adapting to rising rate environment

AKR Balance sheet

as at 30th June 2023 reflects a strong position with Total Assets of

Rp 25,430 billion and Net Equity of Rp 13,284 billion. The company is also

adapting to potential rising interest rate environment in the upcoming quarters

by efficient working capital management leading current ratio to improve to 1.8x

in 6M23 from 1.4x in 4Q22. The net gearing ratio is also maintained at the low

level at -0.01x indicating cash position

improvement in 6M23.

Balance sheet

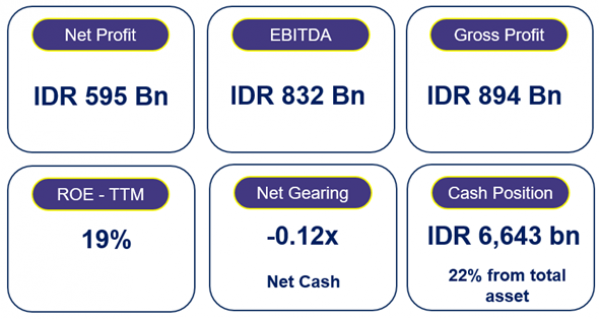

Key Ratios

The Company's reported further improvement in key

financial ratios; Return on Equity reached 19% and Return on Assets to 8%; with

very healthy working capital ratios.

Cash

Position and Net Gearing Ratio

|

|

|

|

|

|

|

|

|

AKRA

is also added to IDX30 by Indonesia Stock Exchange effective from August 1st

2023 to January 2024.

Indonesia

stock exchange added AKR Corporindo (AKRA) to IDX30. This will be effective

from August 1st 2023 to January 2024. The IDX30 is an index that includes

30 stocks that are selected based on liquidity and several other criteria such

as market capitalization, liquidity, company fundamental conditions and company

growth prospects and other criteria that are reviewed every six months.

AKRA committed to ESG improvements towards a

sustainable future through executing strategies such as 1) improve CO2

reporting, 2) supply chain innovation and optimization, 3) sustainable fuel

offering, 4) championing industry 5) developing green industrial estate and 6)

Sustainable economic development. Currently AKR is rated medium risk by Sustainalytics.

The consolidated financial statements that have

been submitted to OJK and IDX today can be downloaded from the company's

website www.akr.co.id

Corporate Secretary and Investor Relations

PT AKR Corporindo Tbk

For More Information please Contact:

[email protected]

[email protected]

→

Download