AKRA 9M 2023 Net Profit IDR 1,710 billion - Grew 9% YOY with Higher Contribution from Industrial Estate Segment Second Interim dividend of Rp 25 per Share declared

October 25, 2023

JAKARTA,

October 25, 2023

PT

AKR Corporindo Tbk., (AKRA IJ) Indonesia’s leading logistics and supply chain

for Petroleum and basic chemicals and developer of JIIPE Special economic zone,

today filed its unaudited financial statements for the 9 months ended 30th

September 2023 with the Indonesian stock exchange.

Release

highlights:

-

PT AKR Corporindo Tbk (AKRA) reported Net Profit attributable to

Equity holders of IDR 1,710 Billion for the 9 month period ended September

30, 2023 compared to Rp 1,564 Billion during 9M 2022 registering a 9% yoy

growth.

-

Consolidated Sales revenue during 9 M 2023 is Rp 29,977 billion

compared to Rp 34,582 billion during the same period last year – volumes grew

while Average selling price was lower due to commodity price decline.

-

Contribution from Industrial Estate segment to AKRA Consolidated

Gross profit during 9M 2023 is now 16%, compared to 5% in 9M22; Gross Profit

from Sale of Industrial land, lease income and utilities during 9M 2023 is Rp

474 bn.

-

EBITDA during 9M 2023 grew 13.4% to Rp 2,552 billion compared to

Rp 2,251 billion during 9M 2022

-

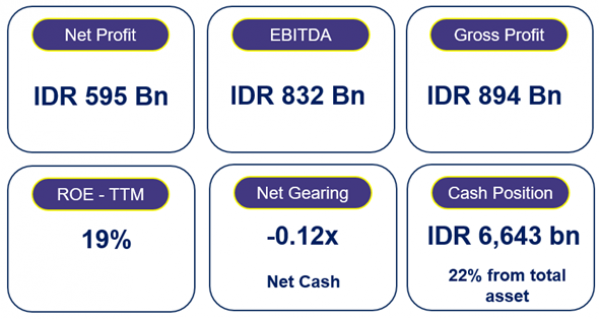

Strong performance resulted in significant improvement in ROE

21% and ROA 8%.

-

Strong balance sheet position with total assets of Rp 28,806 billion

as of 30th September 2023 and low debt;

-

Cash position as of 30th September 2023 is Rp

6,841bn or 22% to total asset. Net Gearing Ratio at -0.17x.

-

Considering the good financial position and significant cash

generation Board of Directors approved a Second Interim Dividend Payment of Rp

493.4Bn or IDR 25/share. Total Interim dividend for 2023 declared is Rp 75 per

share amounting to Rp 1,480 billion.

Key Performance Highlights for 9M 2023

CONSOLIDATED

FINANCIAL STATEMENT

Summary

of Profit and Loss Account For the Nine Months Period Ended 30th

September 2023 (Unaudited)

AKR Consolidated Sales for the 9 months ended

30th September 2023 is Rp 29,977 billion; revenue was lower than the

same period last year due to lower average selling price of petroleum and basic

chemicals;

-

Breakdown of Sales Revenue - 9M

2023:

o

Trading & distribution: Rp 27,918 Billion

o

Industrial estate Segment: Rp 903

Billion

o Manufacturing

and logistic segment: Rp 1,156 Billion

Gross Profit 9M 2023 Rp 2,872 billion – Higher

contribution from Industrial Estate segment

The consolidated gross profit in 9M23 reached

Rp 2,872 billion or improved by 6% with significant improvement from Industrial

Estate segment. The Industrial Estate segment grew by 237%yoy to Rp 474 billion

which also contributes 16% to consolidated gross profit improved from 5% in 9M

2022. Overall Gross Margin during the 9M 2023 improved to 9.6% of Sales Revenue

from 7.9% in 9M 2022.

Balance

Sheet

The

Company continued to maintain a Strong balance sheet with very good liquidity

and low debt levels; As at 30th September 2023 Total Assets of the

Company is Rp 28,806 billion (31/12/2022: Rp 27,188 billion); Total

Equity of the Company is Rp 13,103 billion (31/12/2022: Rp 13,155

billion) reaching 45% of total asset;

The

total Short term and long term borrowings of the Company as at 30th

September 2023 is Rp 4,258 billion while the Cash balance is Rp 6,481 billion (22.4%

of total asset) resulting in Net Gearing of the company: - 0.17x ( NET CASH)

Good

working capital management and adequate cash generation resulted in a healthy Current

ratio of 1.5x

CEO Statement on Financial results 9 months ended 30th September

2023

“ AKRA continues to deliver sustainable growth in all our business

segments resulting in Net profit for the 9 months ended 30th

September 2023 of Rp 1,710 billion 9% higher than the same period last year;

the Company generated EBITDA of Rp 2,552 billion during the 9M 2023, 13% higher

than last year and managed its financial position very well resulting in a Cash

balance of Rp 6,481 billion as at 30th September 2023” said Mr

Haryanto Adikoesoemo, President Director of the Company.

“AKR Trading and distribution business of distribution of Petroleum

products to B to B customers and Retail petrol stations continues to deliver

healthy growth with demand for Bio solar, gasoline increasing during the year;

Sales of basic chemicals which are raw materials to various industries

including Smelters, Rayon, chemical industries etc recorded growth despite

lower average selling prices due to lower prices globally; the Company’s

effective risk management strategies enabled it to manage the price movements

effectively enabling it to improve the Gross margins.”

“ JIIPE Special Economic zone in Gresik East Java, continues to attract

significant investment with signing of Sale purchase agreements, Commitments

for land sales to International Companies setting up large industrial plants in

Indonesia; the contribution of Industrial estate segment has now become

significant and we expect the land sales to accelerate in the coming years

while we have established a strong base for generating significant recurring

income from providing Port services, Utilities such as power, water, gas etc to

the Industrial customers in our Special economic Zone” said Haryanto

“The Board of Directors are very happy to announce a second Interim

Dividend of Rp 25 per share to our Shareholders considering the good

performance and strong financial position of the company; We have already paid

first interim Dividend of Rp 50 per share based on the 6 months results bring

the total amount of Interim dividend to Rp 75 per share in this financial year.

Rp 1,480 billion will be distributed to shareholders as Interim dividend for

2023; The company has rewarded its shareholders with total dividend of Rp 4.5

trillion distributed during the period 2019-Interim 2023.”

Dividend Payment

Schedule

Key Ratios

AKRA

added to IDX30, IDX LQ 45 Low Carbon Leaders and other prestigious ESG indices

Indonesia stock exchange added AKR Corporindo (AKRA) to IDX30. This will be

effective from August 1st 2023 to January 2024. The IDX30 is an index that

includes 30 stocks that are selected based on liquidity and several other

criteria such as market capitalization, liquidity, company fundamental conditions

and company growth prospects and other criteria that are reviewed every six

months. The leading magazine TEMPO also

recognized AKR as a company with a high dividend category, by including AKRA as

part of the IDN-Financial 52 index with the category "High Dividend High

Market Capitalization" until the period March 2023.

AKRA has also now become part of prestigious ESG

indices such as:

- ·

IDX

LQ45 Low Carbon Leaders;

- ·

ESG

Quality 45 IDX;

- ·

IDX

ESG leaders Index;

- ·

ESG

Sector Leaders IDX KEHATI;

- ·

and

became one of 8 companies showcased by IDX as an IDX ESG Star Listed Company.

Additionally, Bumi Global Karbon and Investor

Daily Awarded AKRA with the "Platinum Grade for Emission Disclosure

2023" award which complements other awards in the ESG and Good Governance

sectors such as "Top 50 Big Capitalization Public Listed Company-by

Indonesian Institute for corporate". Currently AKR is rated medium risk by

Sustainalytics.

This can be achieved because AKRA is committed to

implementing best GCG practices and ESG improvements towards a sustainable

future through executing strategies such as 1) improving CO2 reporting, 2)

supply chain innovation and optimization, 3) sustainable fuel offering, 4)

championing industry 5) developing green industrial estate and 6) Sustainable

economic development.

The consolidated financial statements that have

been submitted to OJK and IDX today can be downloaded from the company's

website www.akr.co.id

Corporate Secretary and Investor Relations

PT AKR Corporindo Tbk

For More Information please Contact:

[email protected]

[email protected]

→

Download