AKRA Update March 7 - March 20 ‘2020

March 20, 2020

- Strong Q4 2019 results

- Defense Business model

- JIIPE efforts to get Special Economic Zone (KEK) get a boost

- Share buy back

Strong Q4 2019 Results

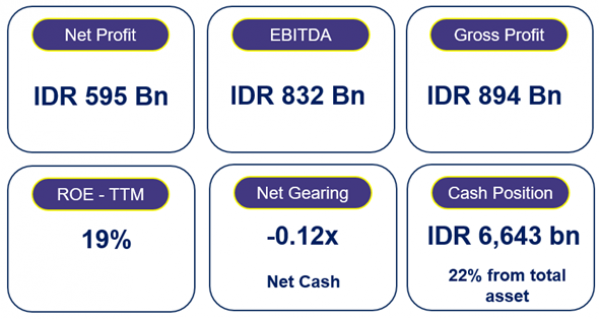

PT AKR Corporindo Tbk announced strong Q4 2019 performance with Gross Profit up 37/73% qoq/yoy and Operating Profit up 57/17% qoq/yoy. Key drivers of strong Q4 performance were 1) Petroleum volume of 691K KL (+33/+21 qoq/yoy), 2) Land Sales revenue of Rp123bn (Rp43bn/zero in Q3 ‘19/Q4 ’18) and 3) Lease income of Rp71bn. Operating expense growth is currently elevated as Company is investing in the roll out of Retail Outlets (BP-AKR joint venture) and in marketing of Java Integrated Industrial Port Estate (JIIPE). The reported Core Net Profit from Continuing Operations of Rp714bn was relative flat yoy. This was due to one-time Receivable write-off of Rp 127bn (explained in Financial Statemen Note35e). Adjusted for this one-off, restated Net Profit for 2019 was +14% yoy and ROE improved to almost 10%. Balance Sheet remains strong with Net Gearing of only 27%.

Defense Business model

The Company Management arranged two Result Calls to facilitate Sell side Analysts, Buy side Analysts and Fund Managers (Presentation and Recording available). Management emphasized the defensive nature of AKRA business model that limits risks in uncertain operating environment. The products that we supply have resilient demand; diesel, motor gasoline, caustic soda, soda ash and other bulk chemicals. These products are used in essential industries like Mining, Transport, Biofuel, Smelters, Textile, Rayon etc. We reiterated that the volatility in oil price has no inventory loss/gain impact for AKR. Detailed diagrams in the Presentation (included in Presentation) illustrate that both oil price and exchange rate are direct pass through to customers. AKR prices its product based on prevailing MOPS (with a lag) plus alpha. The alpha is set as Rp/litre and depends on cost of delivering product/size of the order. The impact of sharp decline in oil prices from March 8, 2020 will reflect in product pricing from April 1, 2020. In the current global environment, we do not envisage any supply disruptions as, 1) petroleum is needed to run the economic activity and 2) most of the chemicals are sourced domestically. In the past cycles, AKR benefitted in low oil price environment; less competition and more flexibility in working capital management. During 2015-16 margins, expanded (as % of revenue).

Strong Balance sheet/low leverage 1) reduces debt servicing risk and 2) gives flexibility in selecting customers for JIIPE land sale. Lower oil price will result in low usage of bank credit lines, reducing liquidity risk. A significant portion of assets is in Industrial Land, funded mostly by equity. Cashflows are sufficient to service debt and maintain healthy payout ratio.

JIIPE efforts to get Special Economic Zone (KEK) get a boost

The Java Integrated Industrial and Port Estate (JIIPE) was visited by Head of the Investment Coordinating Board (BKPM) Mr. Bahlil Lahadalia last week. This visit was part of the JIIPE efforts to be designated as a special economic and manufacturing (KEK) economic zone. Mr. Bahlil Lahadalia said that JIIPE is one of the superior areas that can be offered to investors to invest in Indonesia. "In principle, we from BKPM always support everything that aims to bring in investment, as long as all of it is in accordance with regulations such as licensing and so on," he said. The Director of Pelindo III Mr. Doso Agung said that they had submitted a request for JIIPE to become a KEK for technology and manufacturing since a year ago.

Doso Agung expressed hope that the process will be accelerated now with better coordination between JIIPE, BKPM and the local government.

Source: https://jatimnow.com/baca-24698-pelindo-iii-ajukan-izin-pengembangan-kek-di-jiipe-gresik

Also present during this visit were the Commissioner of AKR Corporindo Mr. Agus Martowardojo, President Director of AKR Corporindo Mr. Haryanto Adikoesoemo and President Director of UEPN Mr. Bambang Soetiono Soedijanto.

Share Buyback

The Company announced share buy back on March 13, effective March 16 to June 12, 2020. This is in Compliance with the Financial Services Authority Regulation Number 2/POJK.04/2013 on the Buyback of Shares Issued by Issuers or Public Companies in Significantly Fluctuating Market Conditions.

The Company has allocated the maximum amount of Rp 500 billion toward the Buyback of Shares. The allocation is inclusive of broker-dealer commissions and other costs in relation to Buyback of Shares transactions. The amount will be used for buyback shares up to 172,631,882 shares or up to 4.3% from total issued and paid-in capital of the Company. The transactions will be carried out prudently by the Board of Directors, with the approval of Board of Commissioners.

The Company believes that the buyback of shares can increase investors’ confidence in the Company and the Company's share price can reflect the value that is based on market multiples. The current stock price of the Company is far below the price that the Company believes as a reasonable market price and very far from the fundamentally reasonable price. The Company also considers that the buyback of shares will create value for the Company's shareholders.

Division of Investor Relation

PT AKR Corporindo Tbk

→

Download